Roof Depreciation Life: How It Affects Your Homeowners Insurance

October 4, 2024 — Homeowner insights | Insurance insights

Your roof is your home’s most important defense against severe weather. But older roofs, or roofs with neglected maintenance, are particularly vulnerable to weather events, such as high winds, hail, and snowstorms. More than 34% of property insurance claims come from wind or hail damage to roofs—the most common insurance claim.1

Most homeowners insurance policies consider the age and condition of the roof to calculate the roof deprecation life—the estimated time frame a roof remains effective and holds its value—when determining coverage limits and roof insurance claim payouts.

If you have an older roof with diminished value, your policy coverage, premium, and payout are adjusted accordingly. While this may result in a lower payout if you file a claim, it also means you’ll benefit from reduced premium costs.

To help you understand and maximize your roof coverage under your homeowners insurance policy, let’s explore a few key factors:

- How roof age affects roofing insurance claims and premiums.

- Replacement cost and actual cash value (ACV).

- How depreciation is calculated.

- Recoverable depreciation for your roof claim.

- How to minimize the impact of depreciation.

How Roof Age Affects Roofing Insurance Claims and Premiums

Roof age directly affects the roof condition, the risk of damage, and the cost of repairs, and insurance companies often consider age when calculating coverage amounts. The key factors that affect the integrity of a roof as it ages include:

- Depreciation: As roofs age, they naturally wear down due to exposure to weather elements like temperature changes, UV exposure, rain, wind, and snow. This wear and tear decreases the roof’s value, leading insurance companies to cover it based on its depreciated value (ACV). This means the payout reflects the current roof’s worth, which considers roof age and condition rather than what it would cost to replace the roof with new materials.

- Increased Risk: Older roofs are more prone to damage, particularly from severe weather events like storms and hail. As the roof ages, its materials may become less effective at protecting the home, increasing the likelihood of a claim. Insurers recognize this increased risk and may adjust premiums or coverage terms accordingly. Homeowners insurers may also cancel policies due to the risks of older roofs.

- Cost to Insure: Older roofs may lead to higher premiums because of the increased likelihood of damage and the higher costs associated with insuring them. Insurers may also impose higher deductibles or policy limits for roof-related claims. For instance, an insurance company may place coverage limits on roofs over 20 years old, providing coverage for ACV, which accounts for depreciation, instead of replacement cost value (RCV). This can result in a lower payout if the roof is damaged.

Replacement Cost Versus Actual Cash Value

Replacement cost and ACV are terms used to determine your claim payout for a covered loss. Understanding these differences is critical when choosing an insurance policy; they affect the amount you will receive to recover from a loss. Homeowners who prefer more comprehensive coverage may opt for an RCV policy, which provides more financial protection. Individuals looking to lower their premiums might choose ACV, understanding that it comes with higher out-of-pocket risks.

- ACV refers to the value of the property at the time of loss, factoring in depreciation. It reflects the roof’s current market value when the damage occurred, not the amount it would cost to replace it.

- Suppose you have a hail damage insurance claim for the roof. If you paid $20,000 for your roof when it was installed, and now it’s 15 years old with an expected lifespan of 20 years, the ACV payment would be around $5,000, minus any deductible.

- RCV is the amount the insurance company will pay to replace your roof with a new one of similar quality without factoring in depreciation. This value is typically higher because it covers the cost of a full replacement rather than the depreciated value.

Using the same roof scenario, if the replacement cost today is $20,000, an RCV policy would pay out $20,000 (minus your deductible) to replace the roof, regardless of its age or condition.

You can read more here for an in-depth look at replacement cost, market value, and purchase price.

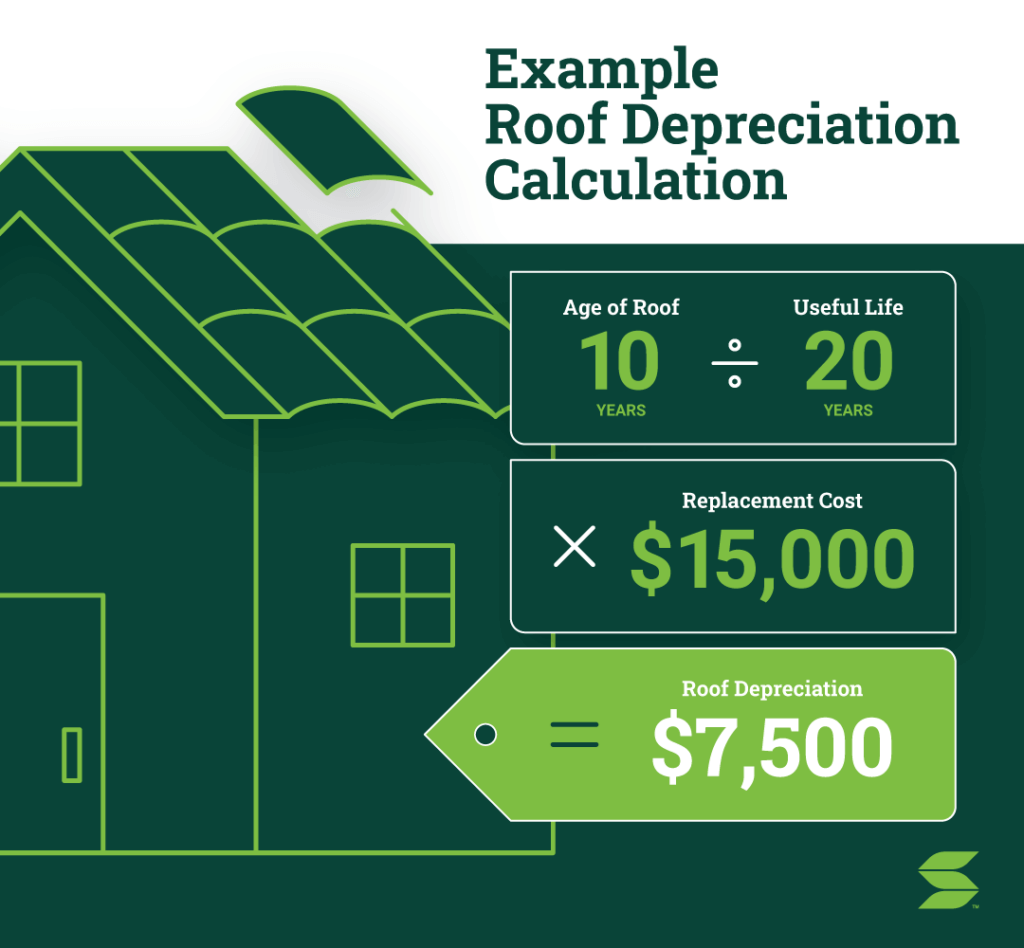

How Depreciation Is Calculated

Depreciation is calculated by estimating how an asset’s value decreases over time due to age, wear and tear, and deterioration. Here’s how it’s calculated for your roof.

1. Find the Useful Life: Determine how long the roof is expected to last.

2. Determine Replacement Cost: Figure out how much it would cost to replace the roof today.

3. Calculate Yearly Depreciation: Divide the replacement cost by the useful life to see how much value the roof loses each year.

4. Total Depreciation: Multiply the yearly depreciation by the roof’s age to get the total depreciation.

5. Get Depreciated Value: Subtract the total depreciation from the replacement cost to determine

This final number is what your insurance company might use to determine the payout if you have an ACV policy.

What Is Recoverable Depreciation on a Roof Claim?

Recoverable depreciation for your roof claim refers to the portion of depreciation on damaged property that you can reclaim or recover after a loss. When you file a claim, your insurance company might initially only pay the ACV of the damaged property, which is the replacement cost minus depreciation. However, if you replace or repair the property, you can often recover the depreciation amount by submitting proof of the repairs or replacement

How To Minimize the Impact of Depreciation

Unfortunately, you cannot slow down depreciation or influence how it affects your insurance coverage, but here are some steps you can take to minimize the impact.

1. Tell Your Insurance Company if you Update Your Roof

Your policy declarations page details the information your insurer has on file for your home. Periodically review your insurance policy to ensure it reflects your current roof year and roof material, as this information affects your premium and coverage, and is used to factor depreciation. Click here for other things you should always tell your insurance company.

2. Review Your Coverage

It’s always a good idea to review your coverages each year to ensure you have the protection you need. During your annual evaluation, make sure your policy includes provisions for recovering depreciation. For the highest financial protection, you can also opt for replacement cost coverage. This type of coverage reimburses you for replacing damaged items without deducting for depreciation.

3. Maintain Your Property

Well-maintained and updated roofs perform better against the elements. Regular roof maintenance helps you detect problems early, which typically extend the roof’s lifespan and reduces claims. Learn more about how to maintain your roof and protect it from storm damage.

If you’re ready to replace your roof after understanding roof depreciation and your coverage, be sure to ask these important questions before hiring a roofer.

1. https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insuranc