Business Insurance in North Carolina

Business Insurance in North Carolina

What is commercial insurance?

In short, it’s insurance for business owners that protects property and provides general liability coverage. When commercial lines are combined in this way, they provide safeguards against many of the most common risks that small businesses face.

We confidently recommend the SafePort and SURE BOP because of features like:

- Wide-ranging coverage, priced competitively

- Capacity across the state of North Carolina

- Broad appetite for risk

- Flexible payments available

- SageSure customers with current personal lines receive discounts

Who needs commercial business insurance?

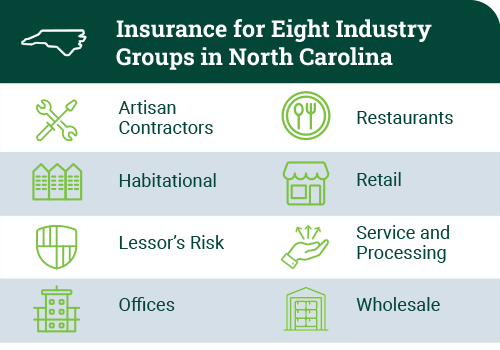

Every business owner should have business owners insurance to secure their financial assets, income, and property. The best safeguard against fire, damage, loss, theft, injury, and other disasters is a dependable and stable policy. Our BOP from covers more than 400 classes in eight different industry groups across North Carolina.

For agents:

Protect North Carolina small businesses. Enroll with us to start offering commercial insurance quotes with our highly rated SafePort and SURE BOP.

Contact us with questions or for more information about our products.

Marc Hatcher

If you’re a policyholder and have questions about small business insurance from SageSure, contact our customer care team at (800) 481-0661

Are you a business owner interested in BOP insurance through SageSure? Find an agent near you to get a quote.