California Business Insurance

California Business Insurance

What Is a BOP?

A business owners policy is a commercial insurance bundle that provides general liability and commercial property coverage. A BOP helps address many of the most common losses and liabilities associated with owning a small business.

Who Needs a BOP?

Every small- and mid-sized business owner could benefit from a BOP’s protection. Not only can a BOP help safeguard income and assets against common causes of loss, but it may also help small businesses grow as many commercial contracts and leases require the basic coverages a BOP offers. In catastrophe-exposed regions of the US, a BOP can be especially instrumental in reducing business interruption and recovering from a major loss or natural disaster.

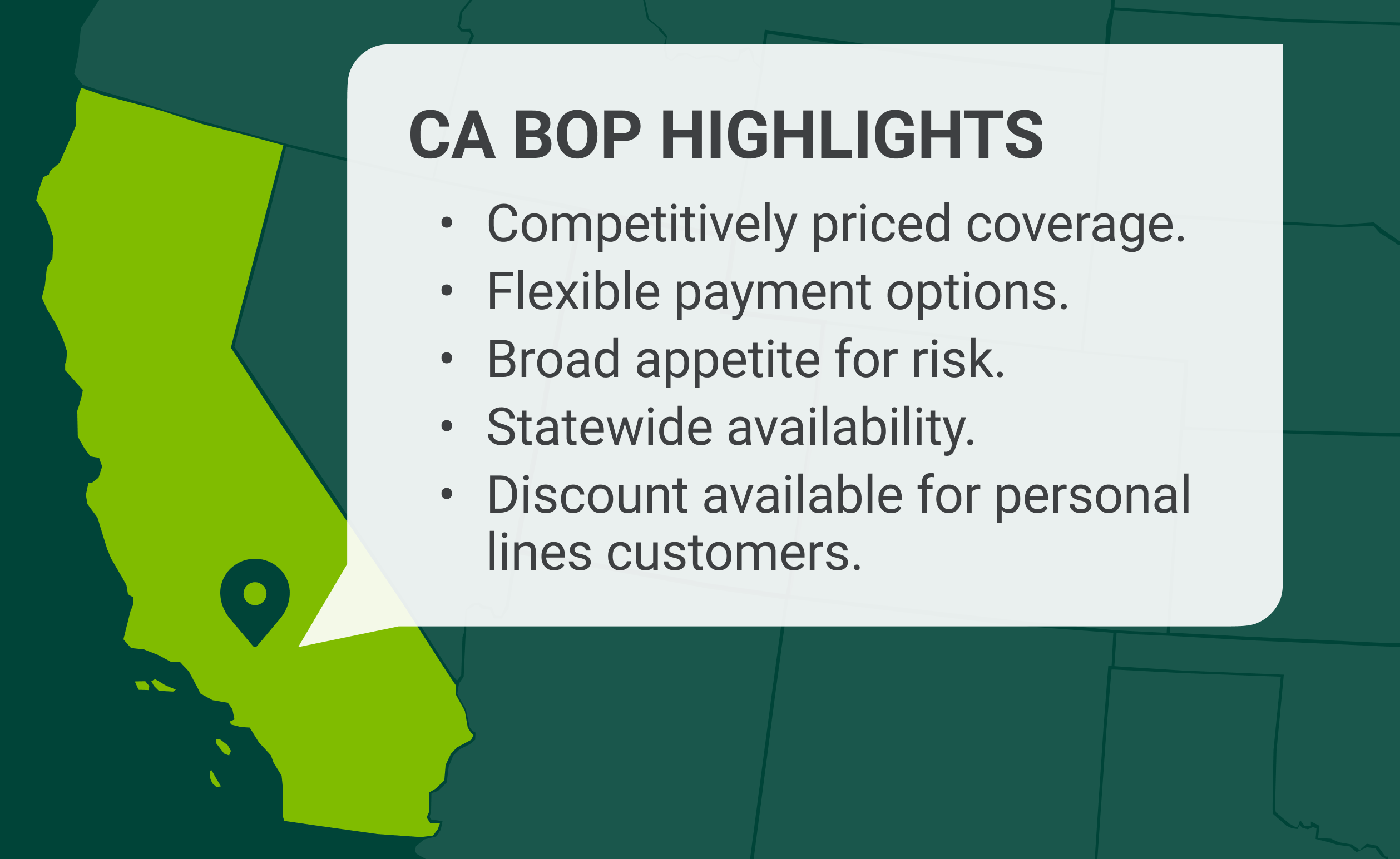

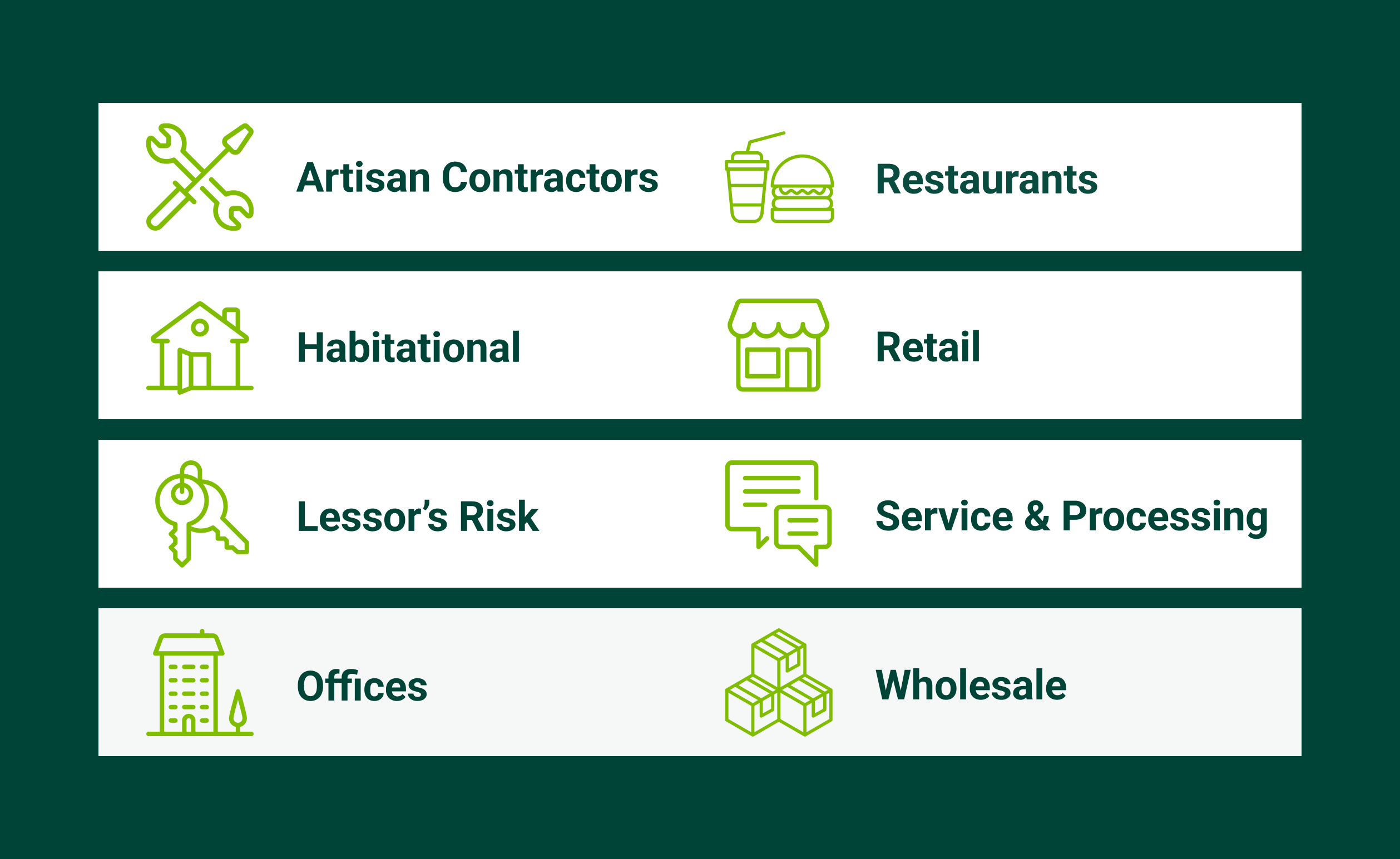

The BOP available from SURE and SafePort have broad eligibility to accommodate more than 400 classes across eight industries, including restaurants, offices, wholesale, habitational, lessor risks, retail, service, and artisan contractors.

Ready to Grow with Commercial in California?

Partner with SageSure to get instant access to quote commercial products.

For more information on how to win with BOP in California, contact: