Business Insurance in Florida

Business Insurance in Florida

What is a BOP?

BOP is short for business owners policy, and it’s the term applied to commercial property insurance combined with general liability coverage. A BOP helps protect against many of the most common hazards of owning and operating a small business.

The SURE BOP is a reliable, thorough coverage option that you can trust. Here are a few reasons why:

- Rated A, Exceptional, by Demotech

- Priced competitively, with flexible payment options available

- Broad appetite for risk

- SageSure personal lines customers can get BOP at a discount

Why do you need a BOP?

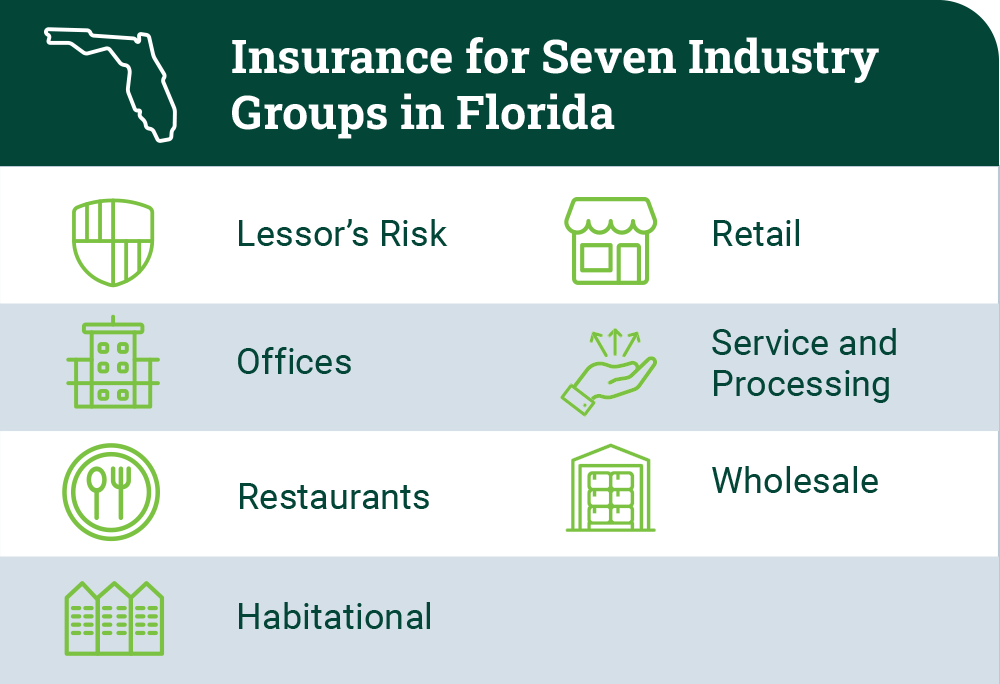

Our highly rated BOP from SURE will help protect your business from loss of income, property damage, theft, fire, injury liability and other included disasters. With so many risks associated with being a small business owner, you need coverage you can trust for your property, income and financial assets. The SURE BOP covers 300+ classes in six different industry groups.

Agents ready to grow with SURE BOP:

Partner with SageSure to quote commercial lines! Help protect Florida small businesses.

For more information on how to win with BOP in Florida, contact:

Marc Hatcher

If you’re a policyholder with questions about Florida small business insurance, please contact our customer care team at (800) 481-0661.

If you’re a small business owner interested in a SURE BOP quote, find an agent near you.

*The products offered by the insurer are of non-admitted status. Insurance policies may be offered on an admitted or surplus lines basis. Surplus lines coverage may only be obtained through duly licensed surplus lines brokers. Any descriptions herein are meant as summaries only and may not include all terms, conditions and exclusions of the policy described.