Family Stories Month: Featuring Alpha Omega Insurance Agency

Family Business Thrives in Second Generation

October 31, 2024 — Business insights | Insurance insights

Family-owned insurance agencies are built on trust, deep-rooted community ties, and excellent customer service—traits that contribute to their longevity and make them great partners. In this series for Family Stories Month, we’ll explore how multigenerational agencies have maintained strong relationships, adapted to industry changes, and continued to thrive while honoring their founders’ legacies.

A FAMILY LEGACY BEGINS

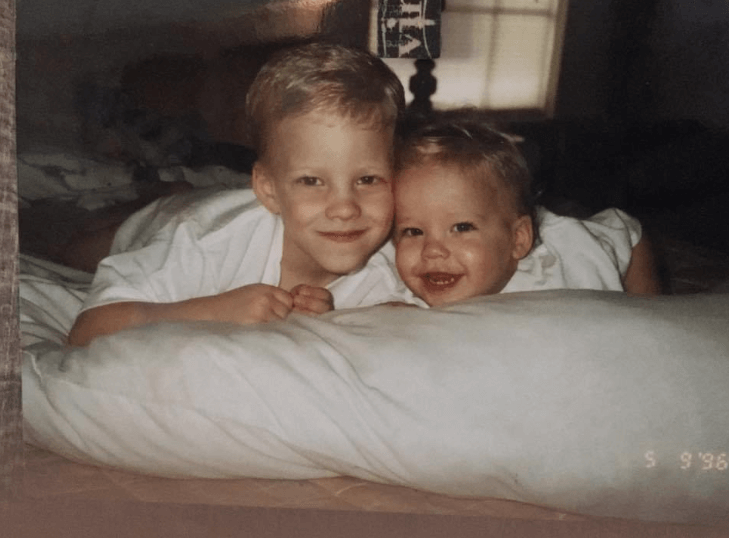

When Kevin and Jason Brown were little, their mom found them in their bedroom playing together—but instead of trucks or blocks, they were deep in an imaginary world where Kevin was selling insurance to his younger brother Jason.

It’s not how most four- and seven-year-old boys spend their time, but then most boys this age didn’t have a dad like Kyle Brown. For Kyle, insurance—being there for families in their time of need—was a thread woven into the fabric of life.

Kyle launched his career in the industry as an agent for a large carrier when Kevin was just a baby. After 14 years, the carrier pulled out of his market, and after much consideration, Kyle decided it was time to open his family-owned business.

BUILDING THE FAMILY BUSINESS

“So, I started over at age 43,” Kyle said, referring to when he started Alpha Omega Insurance Agency. “I had a wife who backed me, supported me, and let me work hard to rebuild. She’s as much a part of it as I was because I had to have the freedom to be able to do it.”

In just two decades, Kyle expanded his family business from a single employee to a thriving team of 34, now generating around $36 million in premiums annually. Reflecting on the company’s guiding principles, Kevin shared the philosophy that continues to shape their success.

“A lot of what we try to center everything around is making people better stewards of their money and making them better stewards of their resources,” Kevin said. “Allowing people to use their money wisely to buy the right kind of insurance and to understand what they’re buying and doing it honestly and transparently is important. Especially today.”

Family-owned businesses like Alpha Omega Insurance Agency are the backbone of the US economy. There are around 32.4 million family-owned businesses in the US, making up 87% of all businesses in the country, according to FamilyBusiness.org. These businesses are responsible for employing about 62% of the workforce, or approximately 83.3 million individuals, and contribute significantly to the private sector’s gross domestic product (GDP).1

RAISED IN A WORLD OF INSURANCE

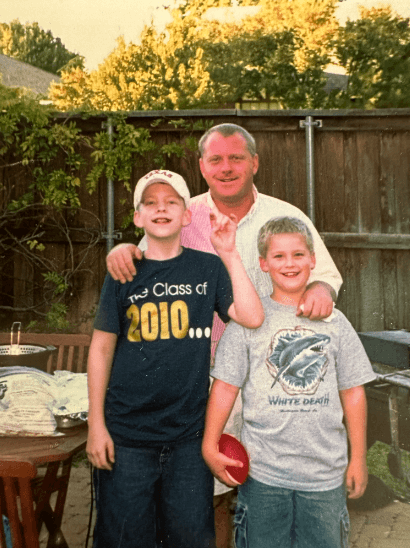

For the Brown family, insurance was more than just a 9-to-5 job. As kids, they regularly visited their dad’s office often followed by a treat at the nearby shop. Even casual games of basketball, like horse or pig, came with a playful twist—an option to “buy insurance” as part of the fun.

“If you were on the last letter and you missed it, if you had purchased insurance, then you would get an extra shot,” Jason recounted. “And it was funny because it wasn’t until later in life that I realized that nobody else played that way.”

Kevin recalled a time as a kid when it was all hands on deck. “I remember having to go to my dad’s office late on a school night to help him fax policies to find coverage for people when a carrier went out of business.”

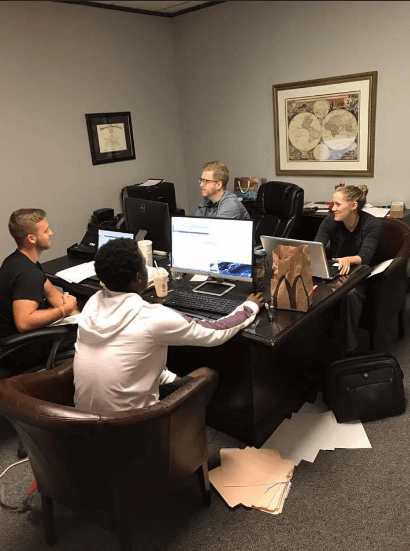

Today, Kevin and Jason turned their childhood make-believe into reality. They aren’t just pretending to sell insurance—they’re running the family business alongside a dedicated leadership team.

The pair say that their father never pressured them to follow in his footsteps. He encouraged them to pursue their passions, whether that meant working with him or choosing a different path.

Kevin recalls deciding to join the family business while still in high school, which led him to pursue a college degree in insurance and risk management.

“There’re not many people who actually go to school for insurance,” he admits. “Pretty much everybody in insurance just falls into it one way or the other. But I’m one of the few nerds who decided to go study it.”

Kevin added that he didn’t choose his major out of a love for insurance, but rather as a backup plan, driven by his love for his father.

“Ironically, you know, my dad and I, we used to butt heads quite a bit when I was in high school and college,” Kevin said. “I don’t think either of us really knew for sure if we were going to be able to work together.”

FROM CHILDHOOD GAMES TO SERVANT LEADERSHIP

After graduation, Kevin spent a year shadowing his dad, soaking up all the knowledge he could—and not just about insurance.

“One of the things that my dad taught me very early on, from the first time that I started working here, was it’s very hard to ask people to do things that you’re not willing to do yourself,” Kevin shared.

And with that mindset of service leadership, Kevin’s gone from selling insurance to vice president of agency sales and acquisitions over the last 10 years—and he can forgo his contingency plan. Working together not only wasn’t a problem, but it was also a gift.

“It’s been the biggest blessing of my career to watch these young guys take this company and take it places that I don’t have the energy to do anymore,” Kyle said.

Three years after Kevin joined the family business, his younger brother Jason came on board. Unlike Kevin, Jason wasn’t sure if insurance was his path. With a degree in biblical studies, he pursued ministry and coached football at a local Christian high school. At his father’s suggestion, he earned his insurance license to explore his options.

“I quickly found out I really loved the insurance side because I love people,” Jason shared. Today he serves as vice president of strategic partnerships.

PART OF THE FAMILY

At Alpha Omega Insurance Agency, it’s about more than just selling policies. The Browns have cultivated a tight-knit culture. They enjoy a sense of camaraderie with a ping pong table and preparing and sharing food together in the office kitchen. “We truly are a family that extends way beyond just Kevin, Jason, and me,” Kyle remarked.

When it comes to selecting carriers to work with, finding a like-minded partner who understands the market and takes care of their customers is a must—the family name is on the line. As Jason put it, “Our customers trust us, and so because they trust us, they trust the company that we put them with.”

Kevin added, “One of the things that I’ve always respected and admired about SageSure is y’all are always looking for more options. You’re always looking for new carriers to add new products and ways to offer coverage solutions for customers.”

LOOKING TO THE FUTURE

Kevin is expecting his first child in January and Jason is expecting his third the same month. Although they would love to see their children take the reins of their multigenerational family business someday, they say they will leave it up to them, while also showing them the rewarding aspects of working for a company that treats everyone like family.

“Watching my clients accept the kids running this company has been amazing to watch,” said Kyle who still spends about three hours a day in the office before his standing afternoon tee time. “But what’s even more amazing, in my opinion, is to watch the agency accept Kevin and Jason as their leaders. Kevin and Jason are the brains that have propelled us where we’re going, and I’m excited to see what’s going to happen in the next decade.”

Continue exploring the multigenerational agency stories: Pinckney Carter Company and C.T. Lowndes Agency.

1. https://familybusiness.org/content/measuring-the-financial-impact-of-family-businesses-on-the-US-ec