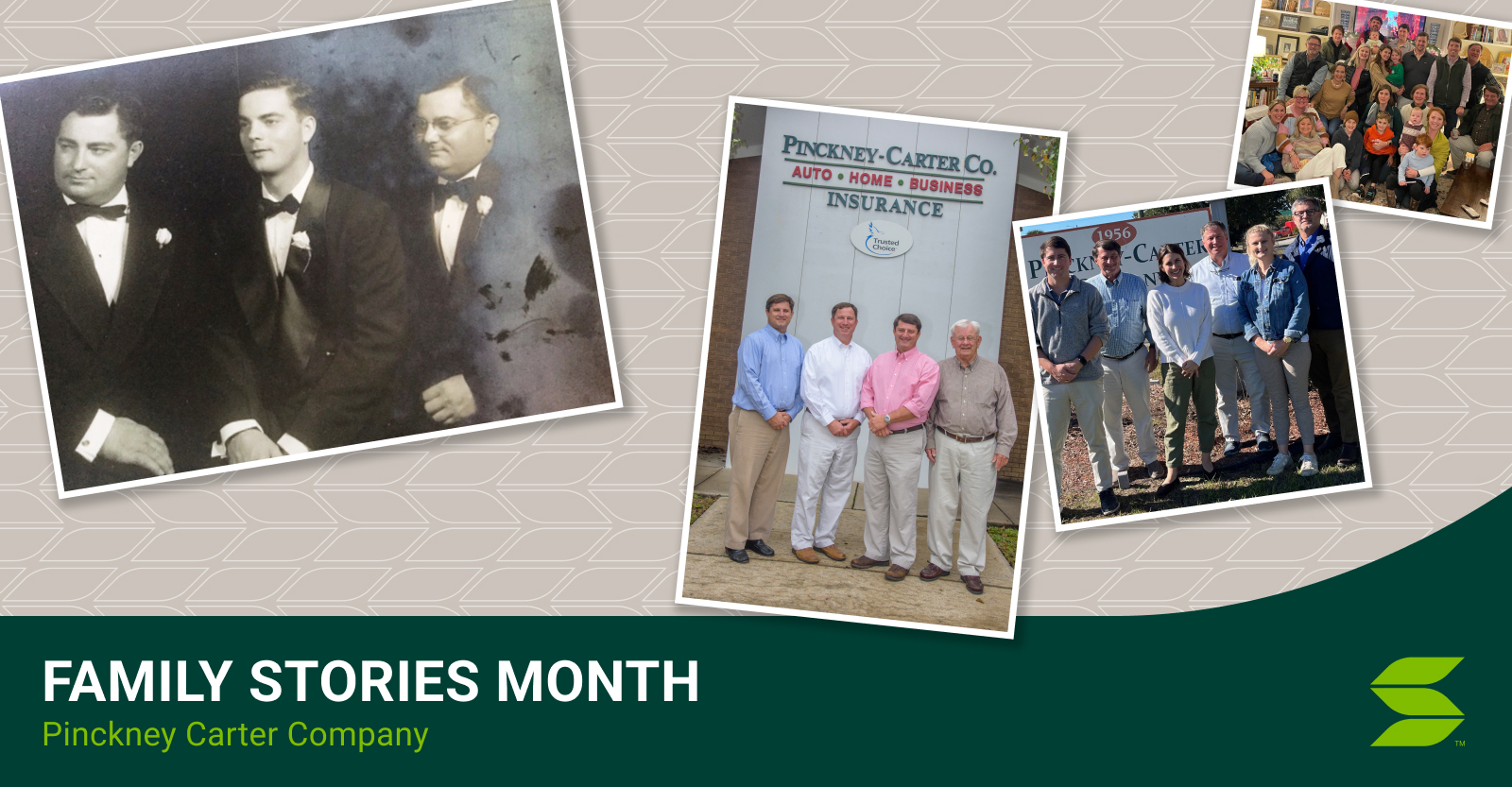

Family Stories Month: The Carter Family’s Multigenerational Business Success

Family Bonds and Trust at the Heart of Pinckney Carter Company

November 25, 2024 — Insurance insights

Family-owned insurance agencies are built on trust, deep-rooted community ties, and excellent customer service—traits that contribute to their longevity and make them great partners. In this series for Family Stories Month, we’ll explore how multigenerational agencies have maintained strong relationships, adapted to industry changes, and continued to thrive while honoring their founders’ legacies.

A LEGACY WITH DEEP ROOTS

The Pinckney Carter Company has provided homeowners insurance for as long as homes have had electricity. Thomas Edison patented the incandescent light bulb in 1880, marking the beginning of electric lighting as we know it—and the founding year of the Pinckney Carter Company.

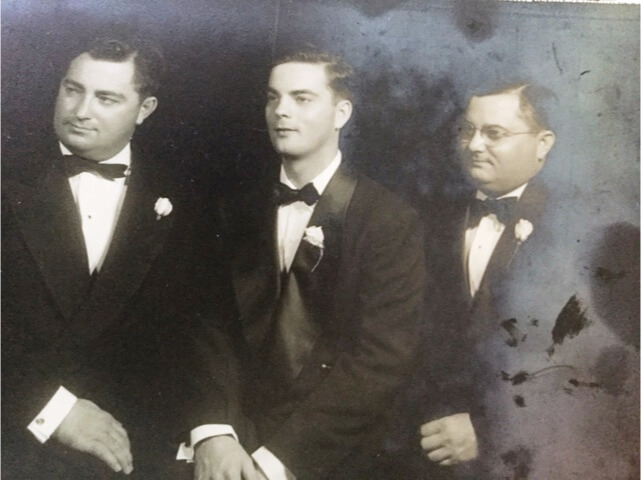

This third-generation, 144-year-old insurance company was started by Clarence Fletcher Carter, Jr. the late grandfather of Cooper Carter. He joined forces with a real estate company, which is where the Pinckney name originated. Today, the company focuses solely on property insurance, and Cooper works alongside his two older brothers to run the family business.

STANDING THE TEST OF TIME

“I think sometimes they say the first generation works really hard, the second generation works a little bit less, and the third generation ruins it,” said Cooper Cater. “But we’ve proved that wrong.”

In 1959, Fletcher Carter, Cooper’s dad, joined the family-owned insurance agency. His three sons followed, with Beau Carter in 1983, JD Carter in 1985, and Cooper in 1990.

Cooper’s oldest daughter, Anne Peyre Carter, joined the ranks as a producer in 2023, bringing the fourth generation into the agency. In addition, Beau’s son Clay joined in 2013, and JD’s daughter Hallie joined in 2018.

“So our tagline is, ‘we haven’t killed each other yet’,” Cooper jokes.

Family-owned businesses account for 64% of the US gross domestic product (GDP), provide 62% of national employment, and drive 78% of new job creation, according to the Conway Center for Family Business. 1 Despite their immense impact, only about 30% of these businesses make it to the second generation, and just 12% reach the third—making multigenerational companies like Pinckney Carter Company rare and remarkable.

HARD WORK, HONESTY, AND FUN: A FOUNDATION OF SUCCESS

Building a successful multigenerational family business doesn’t happen by accident.

“My grandfather and my father always instilled in us to be hard workers and always be honest,” Cooper said. “We’ve all worked equally as hard to build the business.”

Cooper’s grandparents had already passed when he joined the business, but he remembers with fondness the energy and culture they created, where aunts, uncles, nieces, nephews, and siblings all shared a common vision.

“They had so much fun working together,” Cooper recalled. “I was like, this is crazy. I don’t know that I’ll ever do it, but I think it’s pretty crazy that they’re doing it.”

Fond memories include the 65-year tenure of a great aunt, who started when she was 16 and worked until she was in her 80s. “She drove a Ford Mustang convertible and wore a mini skirt in her 80s,” Cooper laughed. “She was hysterical.”

In 1990, Cooper joined the family-owned business and never looked back. This year marks 34 years working in the family business, where regardless of blood Cooper says, “We treat everybody like family.”

So when it comes to choosing partners, such as SageSure, Pinckney Carter says the best partners understand the value of long-standing relationships and commitment to policyholders.

“We’re a lot different than corporate America, you know, so it’s a little bit different feel,” Cooper said. “There probably are not a lot of 4th generation businesses out there today. So we look for partners who understand us as well as we understand them.”

BUILDING A BUSINESS AND FAMILY BONDS

For the Carters, family isn’t just the people you see on the holidays or call once a week. “You just build that close bond, and you know each other pretty well,” said Cooper, about working together each day.

Some of that bond was built in the boardroom, but much of it was built in the breakroom, or for the Carters, the local restaurant just down the street. It served as their standing lunch location for decades and anyone in the office could attend.

“You get to spend more time with your family,” Carter said. “So that’s probably the best part about being in the family business. I got to see my dad more than anyone probably got to see their dad ever because I got to see him every single day and go to lunch with him for so many years.”

Cooper started in the mailroom and answered phones, just like the rest of his brothers, and then chose to manage a satellite office for a few years to spread his wings.

After a hurricane damaged the office, all the offices came together, but the responsibilities are distinct. Beau heads up commercial lines, JD leads the office administration efforts (including IT and accounting), and Cooper oversees personal lines.

“We all have our niches at work, which I think is really good,” Cooper said. “I always know that person has got my back, regardless of what they’re doing.”

BEYOND BUSINESS AS USUAL

Relationships matter, and family-owned insurance agencies like Pinckney Carter Company stand as pillars of trust and reliability.

Cooper knows the community can count on his family. If someone calls and can’t reach him, they can call his daughter or brother. “One of us is accessible when someone has a question,” Cooper said. “We work together as a team. It’s not just about insurance, you know—it’s teamwork, it’s about helping people. It’s a combination of all those things that makes it why I love it so much.”

As a young boy, he didn’t know much about insurance but remembers his dad saying: “When somebody needs us, we show up. When someone needs help, insurance is there.” For the Carter family, this couldn’t be truer.

“Insurance doesn’t just mean the right policies,” Carter said. “It means my family is here. I get to see my brothers, daughters, nieces, and nephews. It means more than just writing someone a policy. It’s not just about insurance, it’s about working with family.”

Continue exploring the multigenerational agency stories: Alpha Omega Insurance Agency and C.T. Lowndes Agency.

1. https://www.familybusinesscenter.com/resources/family-business-facts/