Family Stories Month: C.T. Lowndes & Company Is Six Generations Strong

Multigenerational Agency Stands the Test of Time

December 10, 2024 — Business insights | Insurance insights

Family-owned insurance agencies are built on trust, deep-rooted community ties, and excellent customer service—traits that contribute to their longevity and make them great partners. In this series for Family Stories Month, we’ll explore how multigenerational agencies have maintained strong relationships, adapted to industry changes, and continued to thrive while honoring their founders’ legacies.

AMONG THE ELITE: A SIXTH-GENERATION LEGACY

Occupations like astronauts, Nobel laureates, and Michelin-starred chefs represent rare, elite achievements—milestones only a tiny fraction ever reach.

Henry Lowndes, Jr. may not hold these titles, but he’s part of an equally exclusive group: the elite 3% of family business that survive to the fourth generation or beyond. His family-owned business, C.T. Lowndes & Company, is now in its sixth generation—a remarkable legacy in a world where few family-owned businesses make it past the third generation.

LAYING A FOUNDATION FOR GENERATIONS

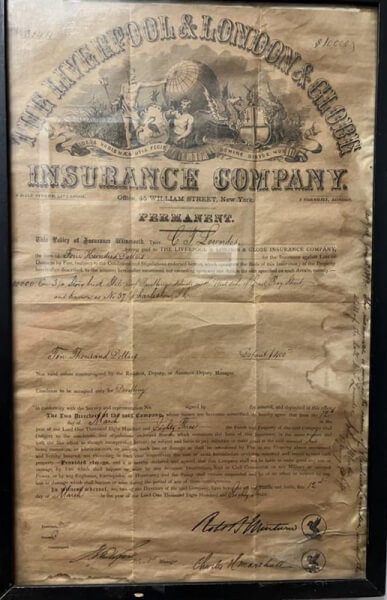

In 1850, the agency was founded by Charles T. Lowndes, the company’s namesake, whom Henry describes as a “shrewd businessman.” In addition to establishing the insurance agency, C.T. was a merchant, a rice broker, and the president of a bank he is credited with saving in the aftermath of the Civil War.

C.T. passed the family business onto his son, Rawlins Lowndes, who ran the company until he passed in 1919, when it was taken over by his grandson Charles Lowndes Maullaly, and eventually their cousin, Henry’s father, Henry Lowndes, Sr.

“After he passed, I found the diary that my father kept,” Henry said. “All of his entries were very brief, but he made one every day.”

According to the journal, on June 15, 1931, after graduating from the College of Charleston, Henry visited the local tailor. Two days later, he started working for C.T. Lowndes & Company. “I guess he had to buy a suit to be employed with the agency,” Henry laughed.

Then, in 1951, Henry Lowndes, Sr. became the sole owner of C.T. Lowndes & Company.

“My father was a man of integrity, and Charles Maullaly was exactly the opposite,” Henry emphasized. “In 1951 my father bought him out.”

EMBRACING CHANGE

Henry Lowndes, Sr. welcomed his sons into the family business, continuing its legacy. After serving in the US Army, the late Edward Lowndes, II joined the company, followed by Henry Lowndes, Jr., who entered the business in 1972 after completing his service in the US Navy.

“We were a very small agency when I started, just five people, my father, brother, myself, and secretary and bookkeeper,” Henry recalled.

With fresh energy came modernization. C.T. Lowndes & Company led the way as the first agency in Charleston to have a computer. Henry said the idea at the time was that it was more cost-effective than hiring additional people.

“It was a huge thing that took up half of my office,” Henry remembers. “I was the person in the agency who knew everything about the computer. If there was any question about it, everyone came to ask me.”

“I can assure you that’s not the case anymore,” he said laughing. “Now, I go ask everyone else.”

By the 1980s, the agency grew to about $500,000 in premium, and Henry sought ways to continue expanding. Coincidently, a high school friend, Billy Silcox, had stopped in and expressed interest in working for the business, and the brothers brought him on board.

“He was a born salesman, and things really took off after he joined,” Henry recalled. “I really give him a lot of credit for the agency still being around.”

THE ENDURING VALUES BEHIND 175 YEARS

The average lifespan of a family business is 24 years, according to the Cornell SC Johnson College of Business. In March 2025, C.T. Lowndes & Company will have hit that mark seven times over, as they celebrate 175 years of business.

Henry attributes the business’s enduring success to his father’s remarkable character, a legacy that continues to shape the company.

“My father was a man of the highest integrity and was honest as he could be,” Henry said. “He gave the agency a wonderful reputation. He was very well thought of and people enjoyed doing business with him. People always knew he would do the best he could for them. We’ve all tried to carry on his ideas of honesty, integrity, and good customer service.”

Sarah Lowndes, one of Henry’s daughters and one of the current owners of the business, witnessed the same traits in her dad. She was only five years old when Hurricane Hugo hit the Charleston area, but she can recall it like it was yesterday.

“I remember everything, leading up to the storm, during the storm, and after the storm,” Sarah said. “And I remember that my dad sent my mom and sister and I out of state. And I remember not understanding why he wouldn’t leave.”

What she couldn’t understand at age five is very clear to her today—it was his commitment to his clients.

“I don’t think he ever left when we’ve had a hurricane,” Sarah said. “And it was always because he has the agency. It was important for him to be there.”

COMMITTED TO CUSTOMER-CENTRIC SERVICE

While the core values have remained, much of the industry has evolved. Henry reminisced about the days when policies were typed up and submitted without an application process, and when insuring a $100,000 building often required coverage from five or six different companies.

And while times have changed, the family has kept the customer at the center.

“I think a lot of insurance agents don’t realize or consider that the average client knows nothing about insurance,” Henry said. “We try to help educate them about what the policy covers and what insurance they should get.”

It’s the personalized service and support that independent agencies offer and what sets C.T. Lowndes apart.

“Every customer has an opportunity to take their business to a larger company if they choose,” Sarah said. “And there’s a reason they’re choosing to do business with C.T. Lowndes, or any other independent agency. And a lot of that is just service.”

BUILDING THE SIXTH GENERATION

In 1985, Henry’s father stepped down, passing the torch to Henry, who led the agency as president and continued its legacy of success. Eight years ago, Henry entrusted the next generation to carry on the family tradition. Today, this family-owned insurance agency is helmed by Billy’s son, Bill Silcox, who is the CEO. Henry’s nephew, Rawlins Lowndes is CFO, and Billy’s other son, Chris Silcox, is the top salesperson. All three are owners, along with Henry’s two daughters, Alice L. Taylor and Sarah, the first female owners of the organization who play integral roles in the agency’s day-to-day operations, ensuring that multigenerational family values remain at the heart of the business.

Sarah sought a career outside of the family business before joining the legacy.

“I needed to get other experience outside of the family business because I needed to bring something to the table of value,” she said.

Today, after spending 20 years building her career, Sarah spearheads the human resources functions within the agency.

“We have a handful of long-time employees who’ve been with the agency for many, many years, some longer than I’ve been alive, some of them who’ve known my sister and me since we were tiny little kids,” Sarah said. “I think that really speaks volumes just to the previous leadership of the agency.”

EVOLVING WITH THE INDUSTRY

As the insurance industry evolves, one thing remains steadfast: the Lowndes and Silcox families’ commitment to their agency and their insureds.

“Finding good insurance partners in this part of the country is extremely difficult because of the hurricanes that take place,” Henry said. “We value SageSure as a partner. They’ve done a good job for us, and they’ve helped us out tremendously. There are so many other companies who are non-renewing policies these days.”

Facing challenges with resilience and staying true to their core values is what keeps this sixth generation thriving—rooted in a commitment to being there in times of need and preserving the family legacy.

“I just feel very honored to be able to be part of a legacy like this,” Sarah said, acknowledging her role in the agency for the last nine years, which she called a “blip on the radar in, in terms of our history.”

“There’s a tremendous amount of pressure that comes with that as well, just to maintain the family legacy,” Sarah said.

The family has meticulously documented their rich history, from the various locations across the city that have housed the agency to key acquisitions and leadership transitions that have shaped its success. Today, with nearly 100 employees and $98.9 million in premium, the legacy lives on.

Henry, ever humble, credits his success to dedication and determination.

“I just became sort of a hard-charge fellow who wanted to do a good job and be successful,” says Henry modestly. “It certainly has provided a great livelihood for me and my family. It’s just good to be able to say you’re the fifth generation, especially in Charleston—where everything is about history. We’re a part of the history of Charleston.”

Continue exploring the multigenerational agency stories: Alpha Omega Insurance Agency and Pinkney Carter Company.