Understanding Earthquake Damage—Insurance, Risk, and Recovery

October 7, 2025 — Disaster insights | Homeowner insights

When an earthquake strikes, the damage can be devastating—cracked foundations, burst pipes, and other destruction, including fires and landslides. Yet, despite the severity of potential earthquake damage, most homeowners remain unprepared. The damage from an earthquake is often underestimated and the insurance coverage can be confusing.

Estimates suggest that nearly 75% of the US could experience a damaging earthquake. And while earthquakes are most common along the West Coast, the U.S. Geological Survey (USGS), reports they can happen anywhere. Moreover, the number of earthquakes has increased dramatically in the central and eastern US over the past decade.

Understanding the problem requires assessing earthquake risk, the cost of earthquake damage, and the insurance gap that separates them.

The Reality of Earthquake Risk

Southern California experiences roughly 10,000 earthquakes each year, though most are too small to feel. Only a few hundred exceed magnitude 3.0, and just 15–20 reach magnitude 4.0 or higher. But earthquakes aren’t just a West Coast problem. Over the past 200 years, 37 states have experienced earthquakes exceeding magnitude 5, according to the USGS.

Is the US Due for a Major Earthquake?

Scientists believe so—though the timing is uncertain. But history and data provide insights into when another quake might be likely.

According to USGS, a massive earthquake like the 1906 San Francisco quake probably happens about every 200 years on the San Andreas Fault. That means it’s not very likely in the next few decades—only about a 2% chance in the next 30 years.

The bigger concern is smaller but still damaging earthquakes (around magnitude 7) on other nearby faults like the Hayward, Rodgers Creek, or Peninsula segment of the San Andreas. Experts warn there’s a strong likelihood one of these will happen in the Bay Area before 2032.

Homeowners Are Underprepared

Despite forecasts, many homeowners underestimate their exposure and delay preparedness for several reasons.

- Perceived Low Probability: Many believe a major earthquake won’t happen, especially if they live in regions that haven’t experienced significant quakes recently.

- Invisible Risk: Unlike hurricanes or floods, earthquakes don’t have warning signs, making the threat seem intangible and less urgent.

- High Cost of Preparation: Reinforcing homes, securing furniture, or buying earthquake insurance can seem expensive, leading homeowners to delay action.

- Reliance on Government Aid: Some assume that federal or state assistance (like FEMA) will be sufficient to recover, not realizing these funds are limited.

- Lack of Awareness: Many are unaware of the damage an earthquake can cause to the home’s structure, contents, or utilities.

- Confusion About Insurance: Many homeowners mistakenly believe earthquakes are covered under their standard homeowners insurance policy, and don’t realize they need separate earthquake coverage.

The Cost of Earthquake Damage

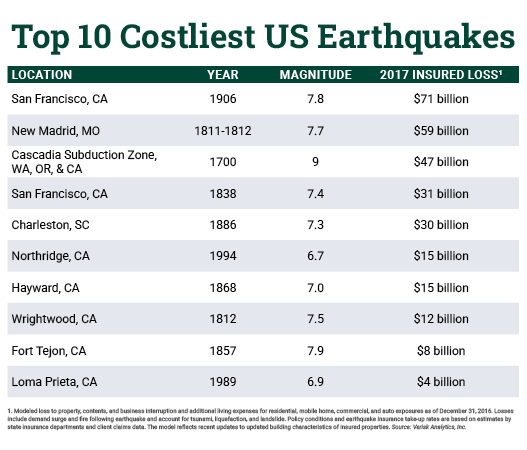

Each year, earthquakes cost the US about $14.7 billion in building damage and economic losses, according to a joint 2023 report by USGS and the Federal Emergency Management Agency (FEMA). If a historic major earthquake were to strike today, modeled insured losses could reach the following amounts, highlighting the 10 costliest earthquakes in US history:

Cost to Repair Earthquake Damage

According to homeadvisor.com, the typical cost to repair earthquake damage is around $15,000, but homeowners can spend anywhere between $5,000 and $25,000. Costs vary by property size, location, and damage severity, ranging from about $1,000 for minor fixes to over $30,000 for major structural repairs—and that doesn’t cover full rebuilding cost after a major earthquake.

The Insurance Gap

Earthquake damage is not covered under standard homeowners insurance policies. Structural damage, fires, or flooding caused by a quake typically fall outside of standard coverage. Even with coverage for fire or water damage, it usually doesn’t apply if it’s triggered by an earthquake. Only a separate earthquake insurance policy or an earthquake endorsement that added to an existing policy can address that damage.

What Does Earthquake Insurance Cover?

Earthquake insurance typically covers:

- Structural damage to the home.

- Personal property, like furniture, electronics, and clothing.

- Detached structures, such as garages, sheds, and fences.

- Additional living expenses (ALE) to cover temporary housing while the home is being repaired.

- Building code upgrades if a reconstruction permit is required to rebuild.

- Loss assessment protection for common or shared property.

- Debris removal to clear away rubble.

Earthquake Insurance Deductibles

Earthquake insurance deductibles are usually calculated as a percentage of a home’s value, not a flat dollar amount. Higher deductibles lead to lower premiums but increase out-of-pocket costs after a quake. A lower deductible will mean higher premiums. It’s also important to understand whether the deductible applies per event or annually, and if personal property or living expenses have separate deductibles. Ultimately, homeowners should choose a deductible they can afford and factor it into their emergency savings.

Does FEMA Cover Earthquake Damage?

Federal aid from FEMA can help homeowners after an earthquake, but it has limits and generally isn’t enough to rebuild a home.

FEMA’s Individual and Household Program (IHP) offers a cap of $87,200: up to $43,600 for housing-related costs and $43,600 for other needs, according to the Federal Register site as of October 2024. Most grants are much smaller—on average, only $4,200, according to the Government Accountability Office.

To qualify for FEMA assistance, the area must be declared a federal disaster, and homeowners must apply and meet certain criteria. Federal aid is meant to supplement, not replace earthquake insurance.

Earthquakes are unpredictable, but preparation doesn’t have to be. Talk to your insurance representative about earthquake coverage to make sure your home and family are safeguarded. Earthquake protection is about more than withstanding the shaking—it’s about ensuring you can recover and rebuild with confidence.